- About

- …

- About

- About

- …

- About

Latest News

February 13, 2026 · Resource ListWe post a weekly resource list featuring key opportunities in Illinois. The Resource List includes workshops, cohorts, career and funding opportunities, and more. Check out this week's resource list! These events are presented by state, local and neighborhood organizations. The list is...February 6, 2026 · Resource ListWe post a weekly resource list featuring key opportunities in Illinois. The Resource List includes workshops, cohorts, career and funding opportunities, and more. Check out this week's resource list! These events are presented by state, local and neighborhood organizations. The list is...January 30, 2026 · Resource ListWe post a weekly resource list featuring key opportunities in Illinois. The Resource List includes workshops, cohorts, career and funding opportunities, and more. Check out this week's resource list! These events are presented by state, local and neighborhood organizations. The list is...More Posts

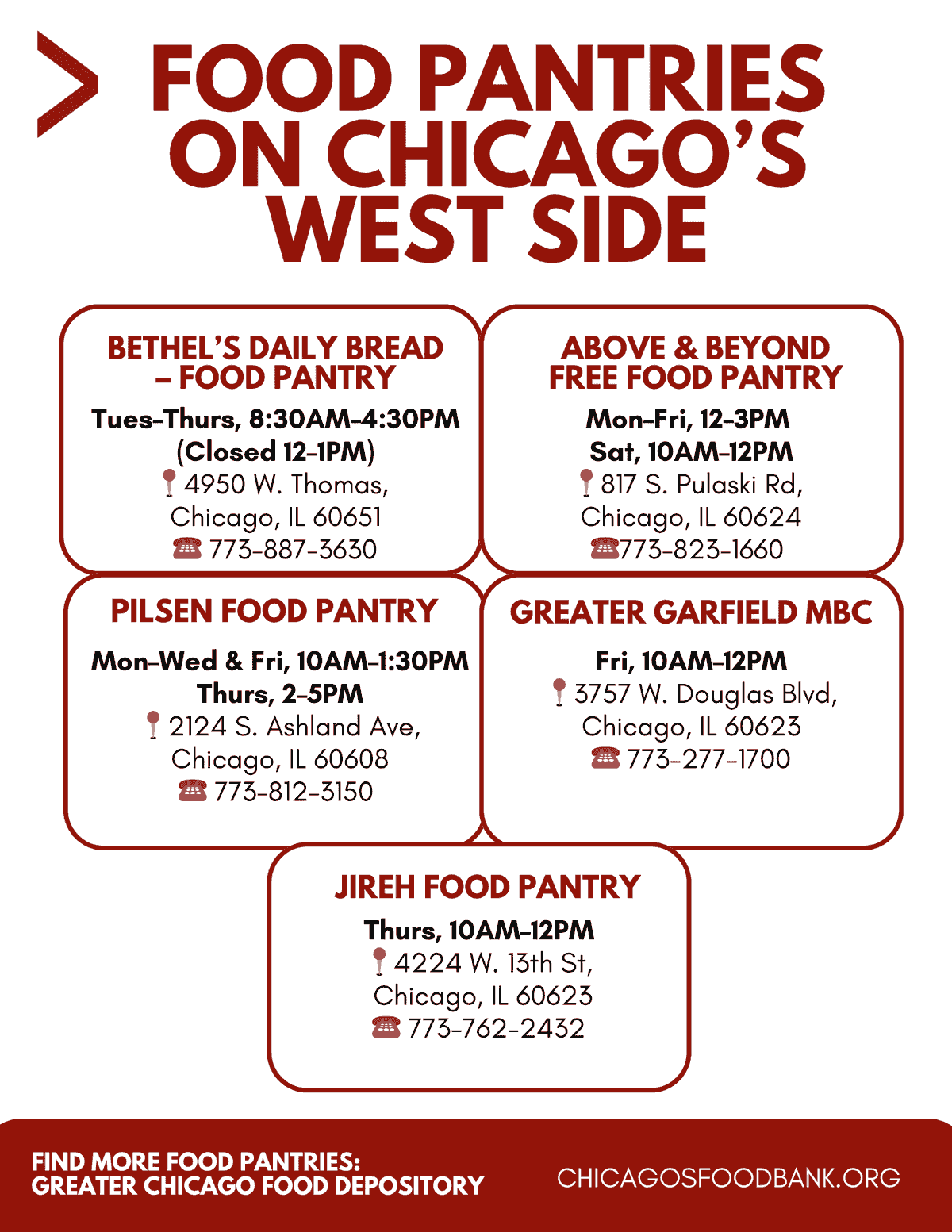

FOOD PANTRIES ON CHICAGO'S WEST SIDE

Due to the government shutdown, SNAP benefits may be cut off starting November 1, 2025. Food pantries on Chicago’s West Side are ready to help.

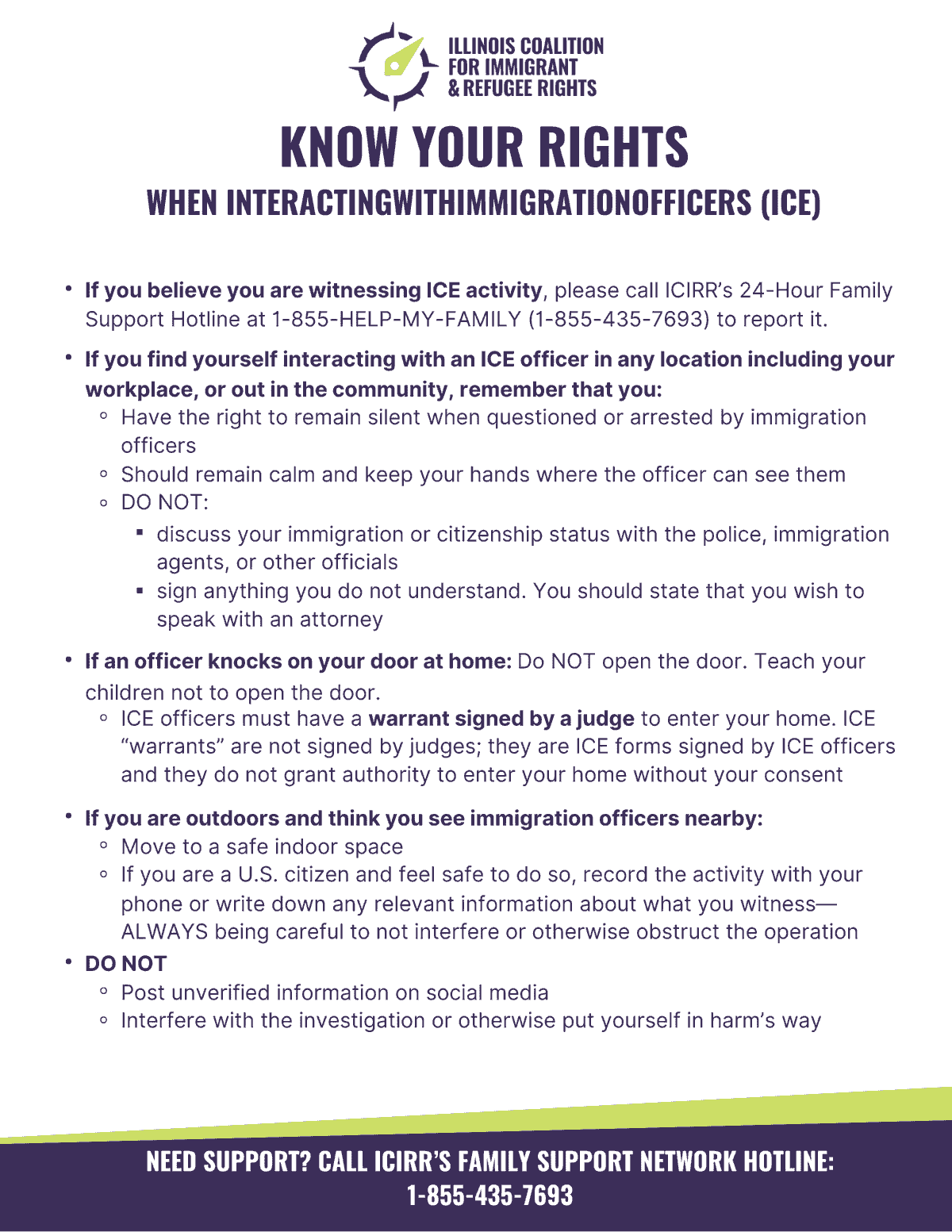

IMMIGRATION INFORMATION

The City of Chicago is offering resources and information to support residents.

OUR STORIES, YOUR IMPACT

West Side Forward is launching the 'Our Stories, Your Impact' campaign. This campaign is a celebration of the past, present, and future of West Side Forward.

West Side Forward © 2019-2025